Pro Forma Financial Statements: A Beginner's Manual to True House Projections

On earth of real-estate investing, one of the very most crucial tools for evaluating potential houses may be the professional forma calculation. pro forma meaning are economic versions that challenge the near future efficiency of an expense, helping investors know how home may perform below specific assumptions. These calculations give you a distinct overview of estimated money, costs, and potential profits, helping as an invaluable information for making knowledgeable investment decisions.

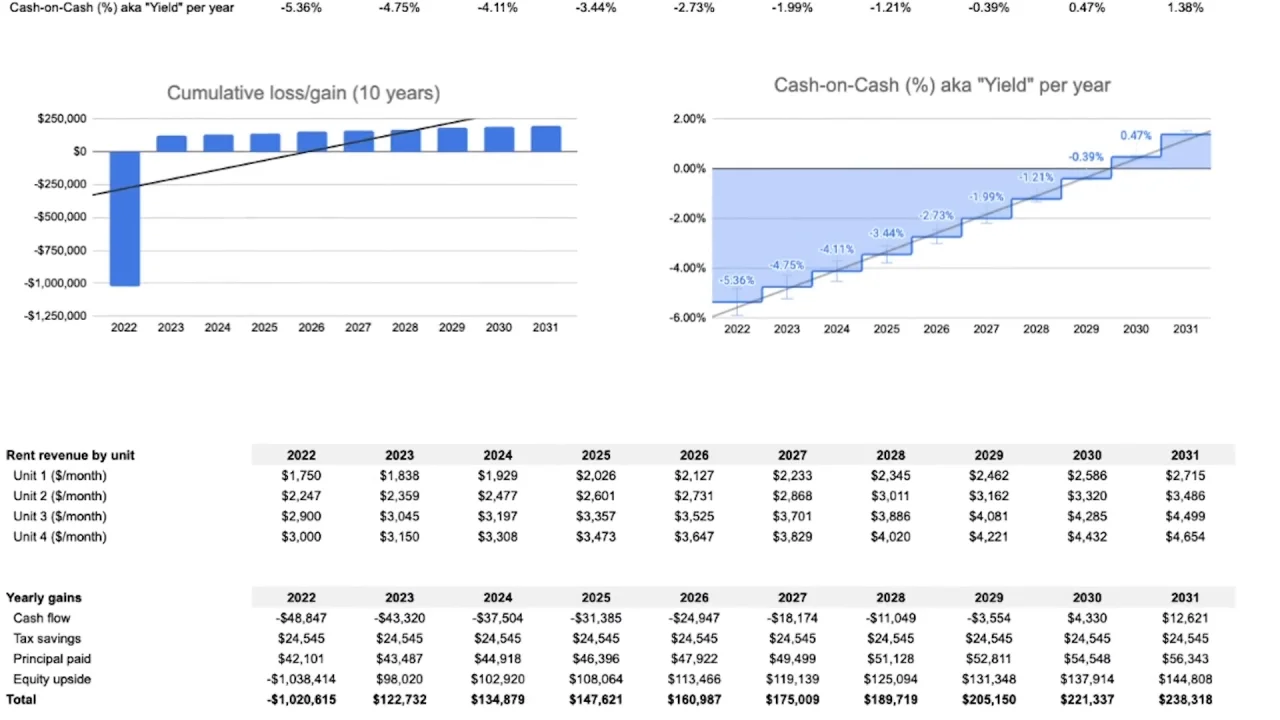

What Is Professional Forma in Actual Property? An expert forma in real-estate is essentially an economic projection that estimates the long run cash runs of an investment property. By costing potential hire money, running costs, financing charges, and home gratitude or depreciation, professional forma calculations give investors an in depth forecast of the property's financial outlook. They are important for predicting gains, determining possible dangers, and assessing whether an investment is worth pursuing. How Pro Forma Calculations Work Professional forma calculations consider a wide range of variables, including: Rental Revenue: Predictions of how much income the home will create from tenants, centered on current market conditions and home characteristics. Operating Costs: Estimated expenses for property preservation, management, fees, insurance, and utilities. Financing Prices: Fascination on loans, mortgage obligations, and other associated credit costs. Understanding and Depreciation: Estimated changes in the property's value, along with how depreciation might influence taxes. By factoring in these elements, professional forma calculations give you a extensive see of the property's economic landscape, helping investors consider the potential reunite on expense (ROI) and examine risks. Why Pro Forma Calculations Matter For real-estate investors, precision and foresight are critical when forecasting profits. Pro forma calculations let investors to: Examine Profitability: They supply a definite estimate of rental revenue versus expenses, supporting investors predict internet functioning revenue (NOI) and income flow. Control Dangers: By modeling different cases, investors may assume potential issues like vacancy rates, preservation charges, or fascination charge fluctuations. Enhance Decision-Making: Pro forma statements let investors to examine multiple investment alternatives, supplying a data-driven method of choosing attributes that match their financial goals.

Conclusion In a nutshell, professional forma calculations are essential for real-estate investors who would like to produce sound, data-backed investment decisions. By giving a reliable outlook of profits and potential risks, these financial designs serve as a crucial software for controlling and growing real-estate portfolios. For almost any investor seriously interested in maximizing returns, understanding pro forma calculations is key to success.